26+ prorated taxes calculator

Discover How Easy Filing Can Be with Step-by-Step Guidance Along The Way. Get Started On Your Return Today.

How Do Federal Income Tax Rates Work Tax Policy Center

Prorate a specified amount over a specified portion of the calendar year.

. Proration is inclusive of both specified dates. Find out the benefit of that overtime. Ad Did Your Know You Can File Taxes Online with HR Block.

While its easier to simply use a prorate calculator you can use some. X 105 2100. November 2022 Pay 2023 Second Half Taxes Paid.

Transnation Title Agency is. Web Free Paycheck Calculator. Web To calculate taxes you first determine how many thousands are in the assessed value.

Other states require you to prorate your. Ad Did Your Know You Can File Taxes Online with HR Block. Web If you want to see a percentage of your current salary enter that percentage into the of full-time salary box.

Enter the number of hours. Web Alabama Income Tax Calculator 2022-2023 If you make 70000 a year living in Alabama you will be taxed 11428. Assume that the closing transaction occurs on March 31.

Web Iowa Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Iowa you will be taxed 11972. Discover How Easy Filing Can Be with Step-by-Step Guidance Along The Way. Web Tax Proration Calculator Closing Date.

To do that simply divide the assessed value by 1000. Web Since the closing date is on February 1 the current taxes due are 500 and the prorated taxes for the current fiscal year are calculated from July 1 through January 31. New York County 4813.

1925 of Assessed Home Value. Your average tax rate is 1167. Your average tax rate is 1167 and your marginal tax rate is.

What Landlords Need To Know About 1031 Exchanges Rules. Web The equation is as follows. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the.

This is the amount of prorated tax the. Web You generally use the apportionment percentage in one of two common methods to calculate your state income tax. Multiply the total number of days by the daily tax amount.

Easily calculate how much pro rate rent to charge. If you wish to prorate over a. Get Started On Your Return Today.

1720 of Assessed Home. May 2022 Pay 2023 First Half Taxes Paid. 2000 in real estate taxes per year.

Using the same example 35 per day for 104 days equals 3640. Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web Property Tax Calculator - Estimator for Real Estate and Homes.

So an assessed value of. Find Fresh Content Updated Daily For Calculate my payroll tax. Web The adjusted annual salary can be calculated as.

2100 365 575 per day in taxes. Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator.

Finred

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

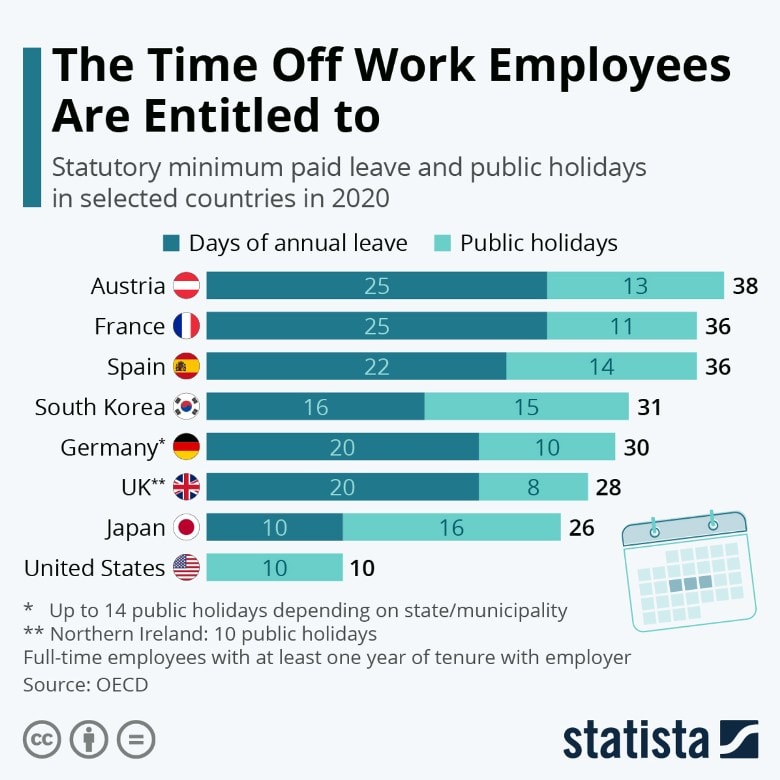

Vacation Days In Germany A Detailed 2023 Guide

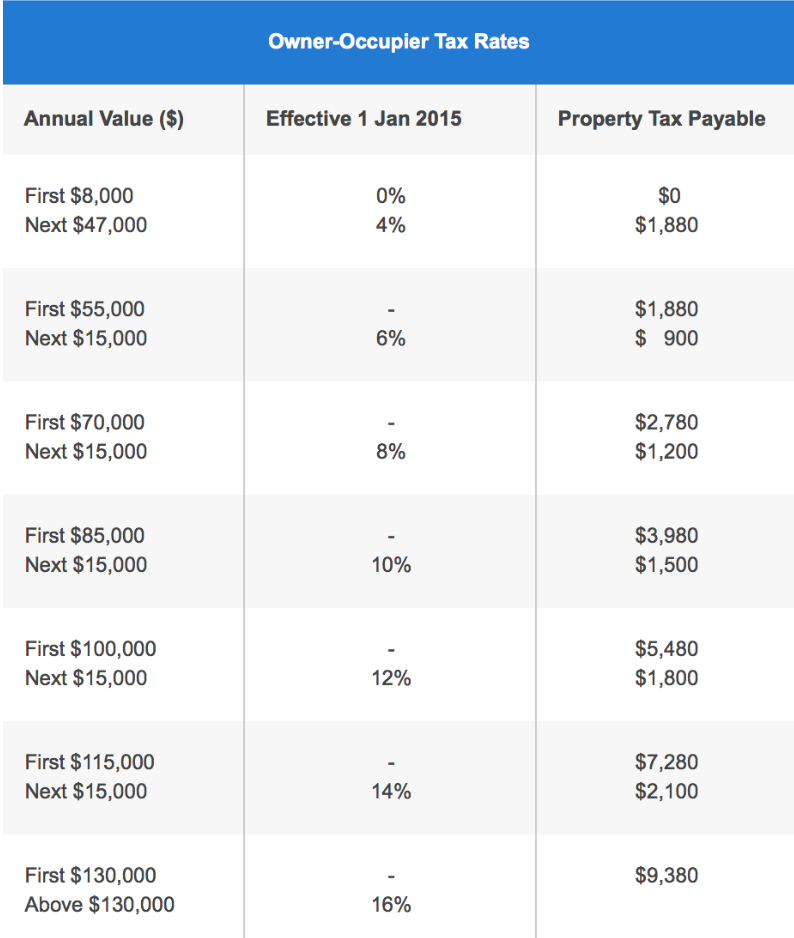

Property Tax For Homeowners In Singapore How Much To Pay Rebates Deadline

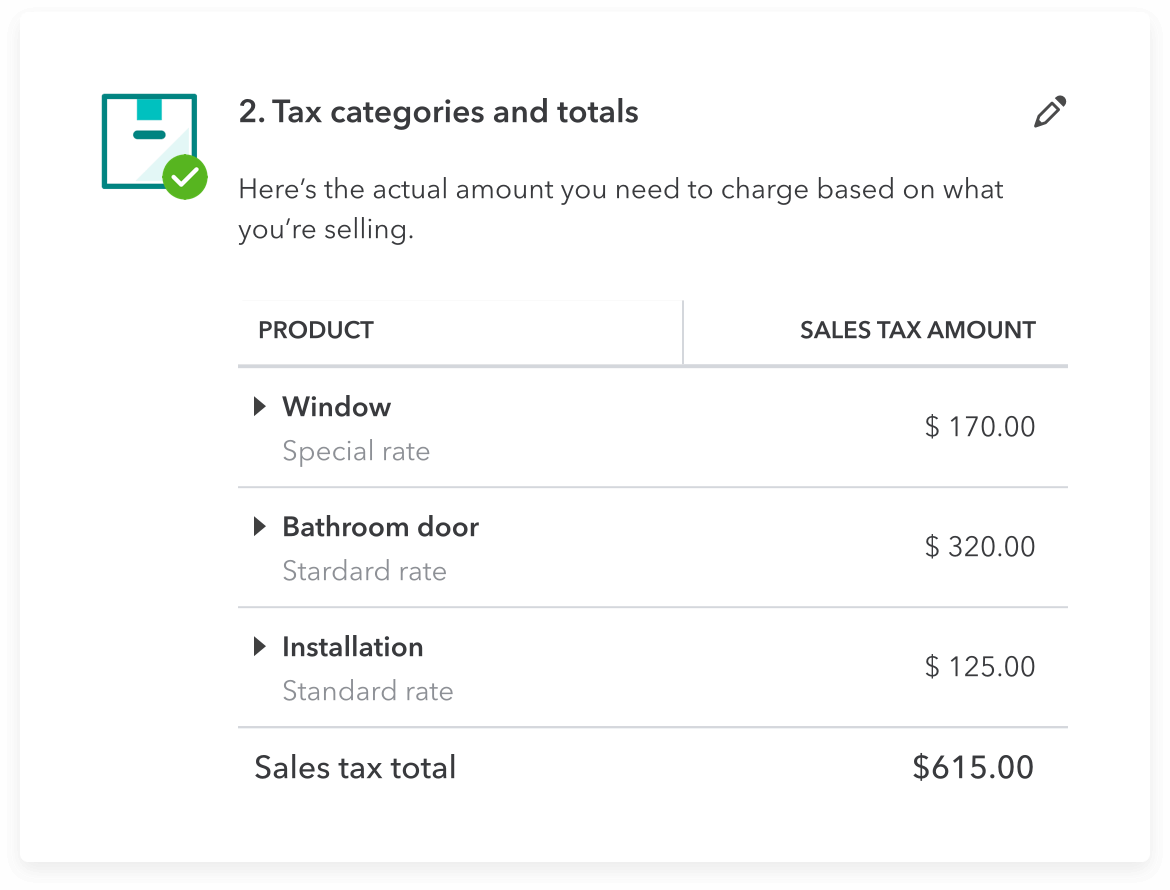

Sales Tax Software For Small Business Quickbooks

How To Estimate Commercial Real Estate Property Taxes Fnrp

Capital Gains Tax Calculator Capital Gains Tax Calculator Jrw Investments

Deconstructing A Tax Law Change The Case Of The Kiddie Tax

Property Tax Calculator Treasurer

Taxes Calculator Image A Calculator Reads Taxes On Its Flickr

Simple Tax Refund Calculator Or Determine If You Ll Owe

Benefit In Kind Tax Calculator Uk Tax Calculators

What Is Property Tax Proration

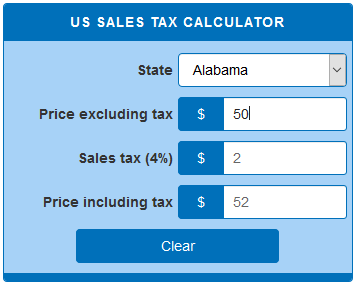

Us Sales Tax Calculator Calculatorsworld Com

Pro Rata Salary Calculator Salary Calculator 2021 22 Wise

How To Calculate Sales Tax On Calculator Easy Way Youtube

Restricted Stock Unit Rsu Tax Calculator Equity Ftw